Energy that mobilizes

Evolution of the results

|G4-DMA Economic Performance|

The results1 achieved in 2016/2017 attest to our ability to continue delivering solid results even in the face of adversity. We ended the crop year with a total of 59.4 million tons of sugarcane crushed, 5% less compared to the previous year due to the decrease in TSH2 from 89 tons/hectare to 80 tons/hectare. This drop is due to the low volume of rainfall and to the crushing of 2.8 million tons in March 2016, included in the previous report. However, the average TRS3, a measure of sugar content in sugarcane, was 129 kg/t, higher than the 128 kg/t from the 2015/2016 harvest.

Regarding fuel distribution, the Brazilian market began 2016 in a downward trend due to the drop in consumption - already observed in previous quarters. According to the National Agency of Petroleum, Natural Gas, and Biofuels (ANP), the volume of fuel sold dropped 4.5% in 2016 in Brazil. Even so, our total sales exceeded the market average showing a small drop of only 1% compared with the 2015/2016 harvest.

In the consolidated result, EBITDA totaled BRL 6,721.4 million, an increase of 11.4% over the previous harvest (BRL 6,035.2 million). Net debt ended the year 2016/2017 at BRL 6,870.4 million, a reduction of 2.8% compared to the past balance of BRL 7,067.7 million. Net income reached BRL 3,062.1 million, a 38.9% increase compared to the BRL 2,204.8 million recorded in 2015/2016.

We remain confident in our trajectory. In January 2017, we entered the international capitals market by completing the first issue of bonds maturing in ten years. Demand from investors was much greater than supply, making the operation achieve an excellent spread, which confirms the trust of investors in the soundness of our businesses.

1Information contained in this section is available in the 4Q17 Business Report.

2Tons of sugarcane per hectare (TSH).

3Total Recoverable Sugar (TRS).

Raízen Energia

Adjusted EBITDA of BRL 3.1 billion

BRL 1.4 billion in net income, an increase of 38.7%

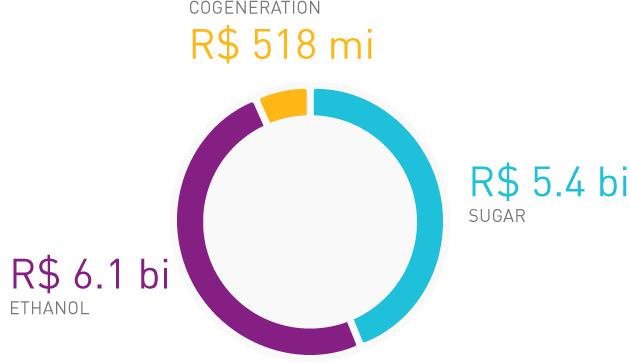

Adjusted net revenue reached BRL 12.3 billion, practically in line with that of the previous harvest. Lower volumes sold were offset by better average selling prices for sugar and ethanol.

Composition of Adjusted Net Revenue

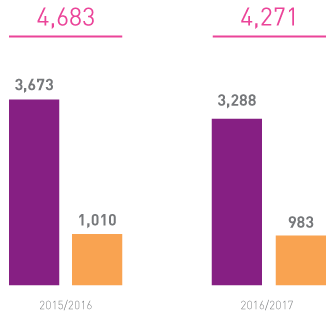

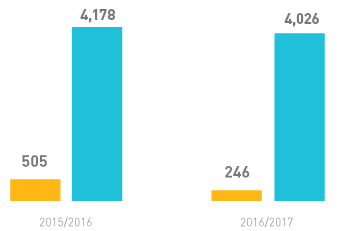

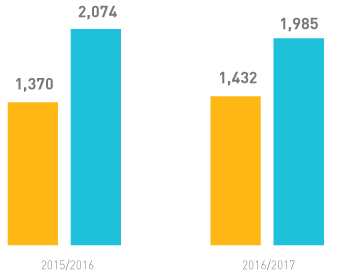

Volumes sold

Sugar (million tons)

Ethanol (million m3)

The cost of products sold totaled BRL 9.4 billion, an increase of 3.8% compared to the previous crop year, mainly impacted by the price increase by the Sugarcane, Sugar, and Ethanol Producers Council (Consecana). Disregarding this effect, the unit cash cost in sugar equivalent was 2.4% lower than in the last harvest, reflecting the continuous focus on efficiency in the agricultural and industrial operation. General and administrative sales expenses were BRL 1.2 billion - influenced by the increase in freight costs.

The lower volume sold, and especially the lower exchange rate, affected the Adjusted EBITDA, which was BRL 3.1 billion, down 11% compared to the previous result. If we consider, however, the effect of the currency hedging in the financial results outside the EBITDA, operating results increased 25% compared to the 2015/2016 harvest, demonstrating the efficiency of our strategy of determining and capturing better prices.

CAPEX reached BRL 2.1 billion, in line with guidance for the period, and reflects greater investments in planting and handling, as well as investments related to health, safety, and environment (HSE), and maintenance.

Value added

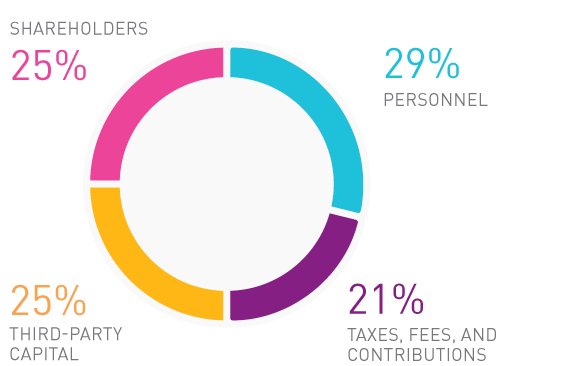

The Value Added Statement (VAS) aims to demonstrate the generation and distribution of wealth of a company among its various external players. In the 2016/2017 harvest, the value added of Raízen Energia totaled BRL 5.6 billion.

Raízen energia - value added distribution in the 16/17 harvest

|G4-EC1|Click here to access the complete Value Added Statement for Raízen Energia. |G4-EC1|

Raízen Combustíveis

BRL 2.9 billion of adjusted EBITDA

BRL 1.7 billion was net income, an increase of 38.1%

We continue with a very positive performance, as a result of lasting partnerships with our dealers. Net revenue reached BRL 69.4 billion, which was 8.9% higher than in the previous harvest, due to higher sales volume and better average prices for gasoline and diesel.

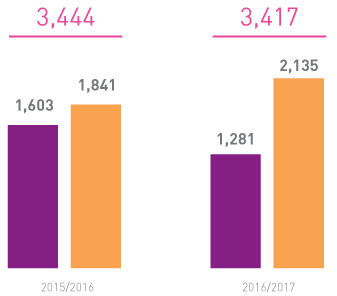

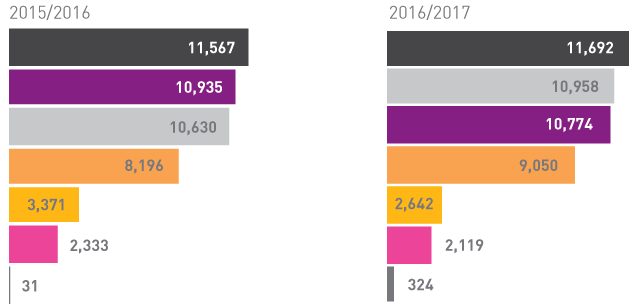

Sales volume

The volume sold of Otto cycle fuel (gasoline + ethanol) increased by 1% compared with the previous harvest. In the same comparison, in gasoline equivalent, the volume was 3% higher, which reflects the positive impact of the 10% growth in gasoline volume versus the 22% drop in ethanol volume.

Gasoline prices were readjusted by Petrobras, which increased competitiveness and demand for the product.

Diesel ended the year with a small reduction in sales volume compared to 2015/2016 (-1.5%). However, it showed a growth of 3% in the last quarter compared with the same period of the previous harvest - reflecting new contracts with industrial clients.

The aviation sector was once again impacted by the reduction in demand for air transportation, with a drop of 9% compared with the previous year. The final data for 2016 by the Brazilian Association of Airline Companies (ABEAR) indicate that, during the period, Brazilian and foreign companies recorded a drop of over 7% in supply, with a decline of almost 4% in demand.

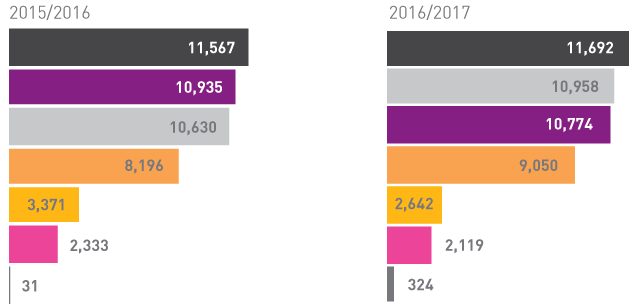

Sales volume (million m3)

Costs and expenses

Cost of goods sold increased 8.4%, totaling BRL 65.6 billion, due to higher volumes, higher fuel costs, and higher expenses associated with logistics. Sales, general, and administrative expenses were BRL 1.7 billion, which was 6.2% higher than in the previous harvest due to the supply strategy.

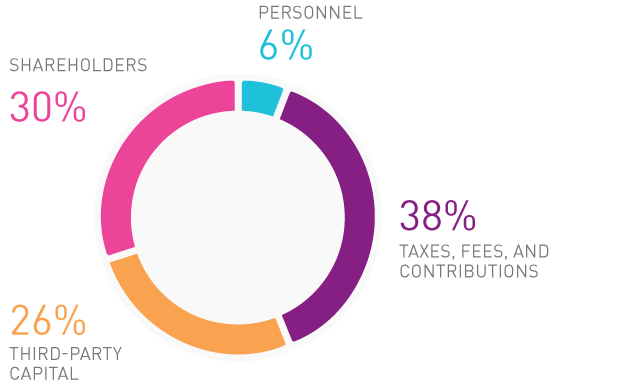

Value added

Value added In the 2016/2017 harvest, the value added of Raízen Combustíveis totaled BRL 5.5 billion, as shown in the chart.

Raízen Combustíveis - value added distribution in the 16/17 harvest

|G4-EC1|Click here to access the complete Value Added Statement for Raízen Combustíveis.|G4-EC1|